iMPACT® by Benchmark –

Data Science-Driven Risk Management for Pools

The iMPACT program adapts the best-practice risk management frameworks published by leading organizations’ Risk Management and Quality Improvement standards. Magic happens when our program combines Benchmark’s law enforcement expertise, research consortium analytics and data science capabilities with a risk pool’s loss control programs, historical database and member subject matter proficiency.

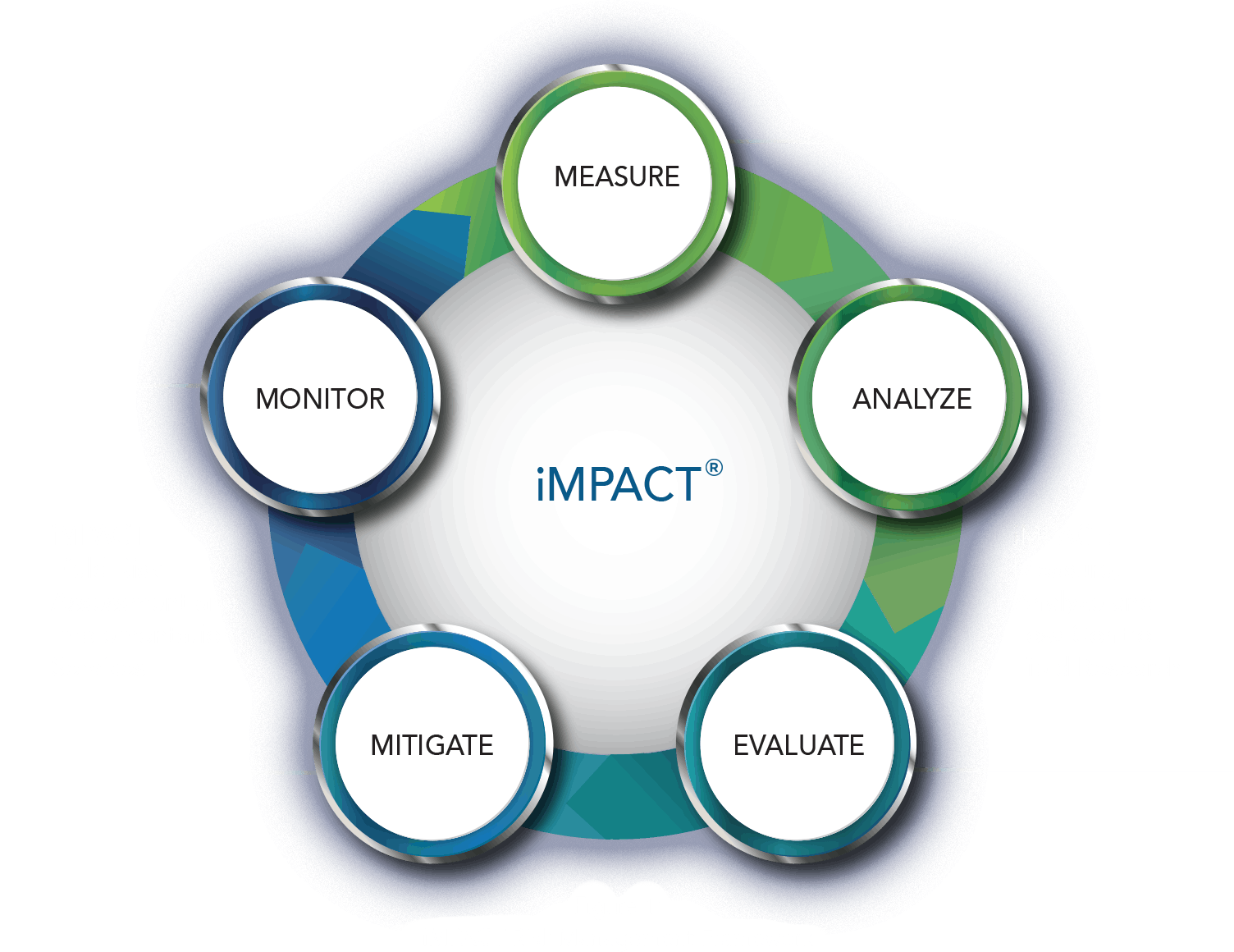

How iMPACT Works

The iMPACT solution consists of a modular set of capabilities – provided by Benchmark as well as key risk pool and stakeholder resources – working in concert to deliver effective risk management cycles with member agencies. Key steps include:

This step is about developing a clear charter with objectives for the program to be implemented. Here, we collectively establish a complete, forward-looking set of predictive risk models for the law enforcement risks facing each pool member — and maintain that understanding over time.

This step engages a pool’s member agencies to “ground truth” the unique risk profile of each municipal member and agency. Through this process, iMPACT becomes a force multiplier for a pool’s law enforcement experts as they engage stakeholders to understand the context of their community and assess the agency’s key risk factors.

iMPACT includes a growing portfolio of evidence-based practices that police agency leaders and experts can consider to address key risk factors such as officer or command staff turnover, supporting calls involving persons in mental health crises, officer mental and physical health, and many others.

- Determine agency risk score for each line of coverage, then set goal to address key risks within the next year.

- Select loss control interventions that are most appropriate to that member’s risk factors from a growing list of proven evidence-based practices provided by iMPACT.

- Implement the plan by partnering with member stakeholders to identify and mutually agree upon a course of action. Confirm plan, resourcing, milestones, and next steps.

- Capture data and provide feedback on process effectiveness to help inform the next iteration of the repeatable iMPACT risk management process.

Helping Each Pool Member Reduce Risk

Simply stated, the iMPACT program enables a pool’s loss control team to help each pool member identify and create a plan of action to address their most pressing risks for each line of coverage. This approach enables each member, and therefore the entire risk pool, to reduce loss costs up to 60%.